Want a deeper understanding?

Watch our short tutorial with Alex Witham. Alex will walk you through how to access and use the calculator, highlighting its key features.

At a glance

- Product specific calculations

Our unique calculator allows you to instantly calculate the maximum loan size, ICR and minimum rental income needed for each product.

- Supports multiple property types

Our buy-to-tet calculator supports multiple property types, including standard properties, HMOs, and MUFBs.

- For individuals, SPV's and LLP's

By incorporating these diverse client structures, this tool is designed to support you in managing a wide array of client scenarios, enhancing your service offerings and facilitating more informed decision-making.

- Instant and easy to use

This tool’s intuitive interface and swift processing help streamline the mortgage application process, making it a valuable resource for handling complex mortgage scenarios, enabling you to provide tailored and precise advice efficiently.

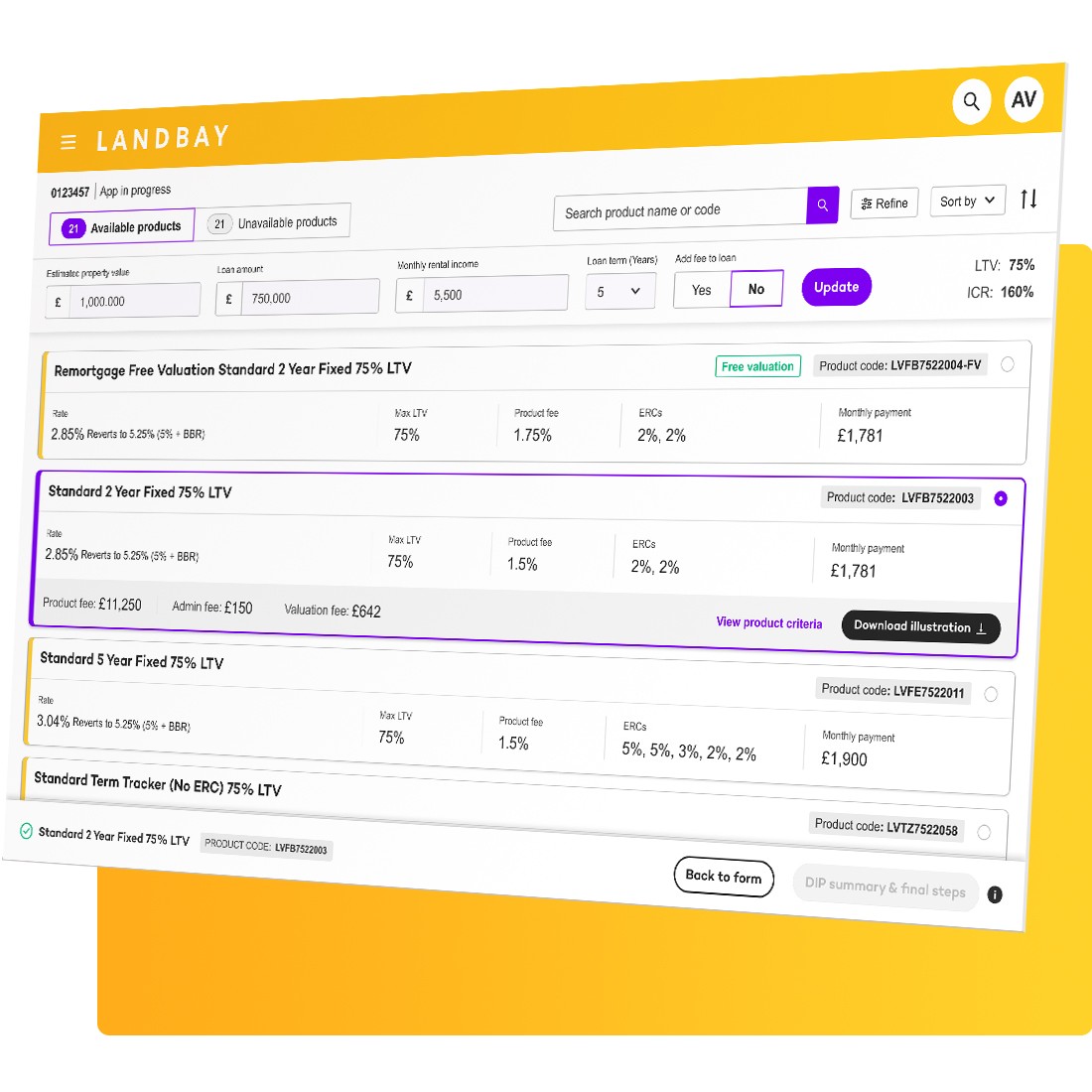

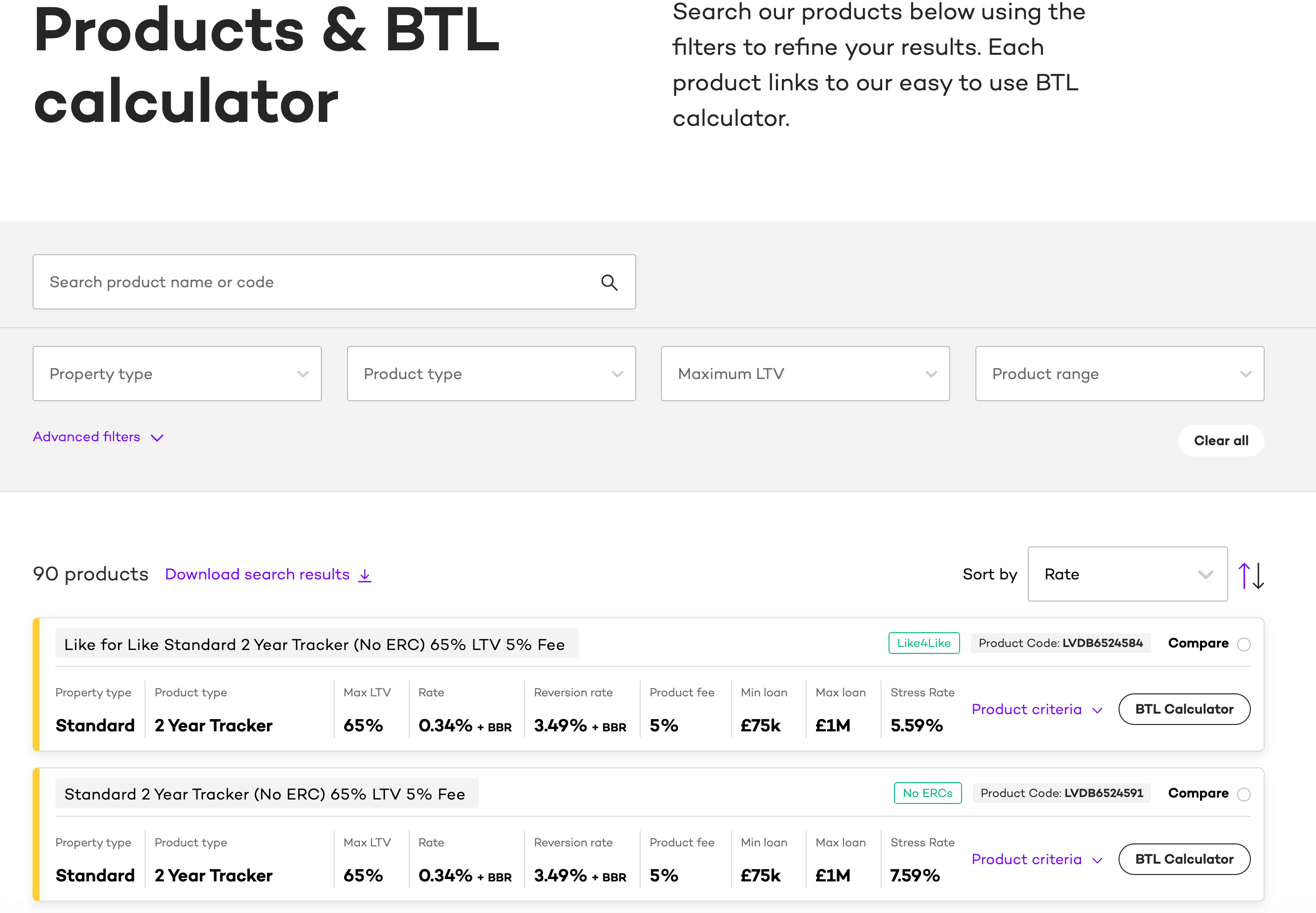

Using the BTL calculator

- Step 1: Access the calculator

- Go to our home page.

- Select ‘Intermediaries’ and click on ‘Products’> ‘BTL Calculator.’

- Use filtering options to narrow down products by type.

- Step 2: Run the affordability calculator

- Run the calculator on individual products or compare up to 6 products by selecting them and clicking the purple button.

- Answer the questions and click ‘Calculate Affordability’ to view maximum borrowing.

- Note: Landbay accepts market rental and personal income (excluding gross rental/future income) for personally owned properties.

- Step 3: Save and share the results

- View the maximum loan based on rental income or switch to the minimum rental income required for a desired loan.

- Start a DIP or click ‘Print’ to save results.

- View up to 4 products side by side and download the comparison.

Latest insights

Guide to Houses in Multiple Occupation (HMO)

A house in multiple occupation (HMO) is a property rented by at least three tenants forming more than one household, sharing facilities like

Smart strategies for HMO investment

Investing in houses in multiple occupations (HMOs) can be lucrative for landlords, yet it’s not without complexities. Investors must do thorough research beforehand.

HMO and MUFB products for first-time landlords

Earlier this year, we launched our first range of products aimed specifically at smaller landlords (those with three or fewer properties) and the

Want to find out more?

Choose Landbay today and you’ll find experts at the end of the line, smart technology designed for you, and fast decisions you can count on.

Request a callbackFind your local BDM

Already registered? Login