Blog

The Government needs to restore confidence in the buy-to-let market

20 March 2025

Landlords are increasingly disillusioned with government policy, and our latest survey highlights how deep the frustration runs.

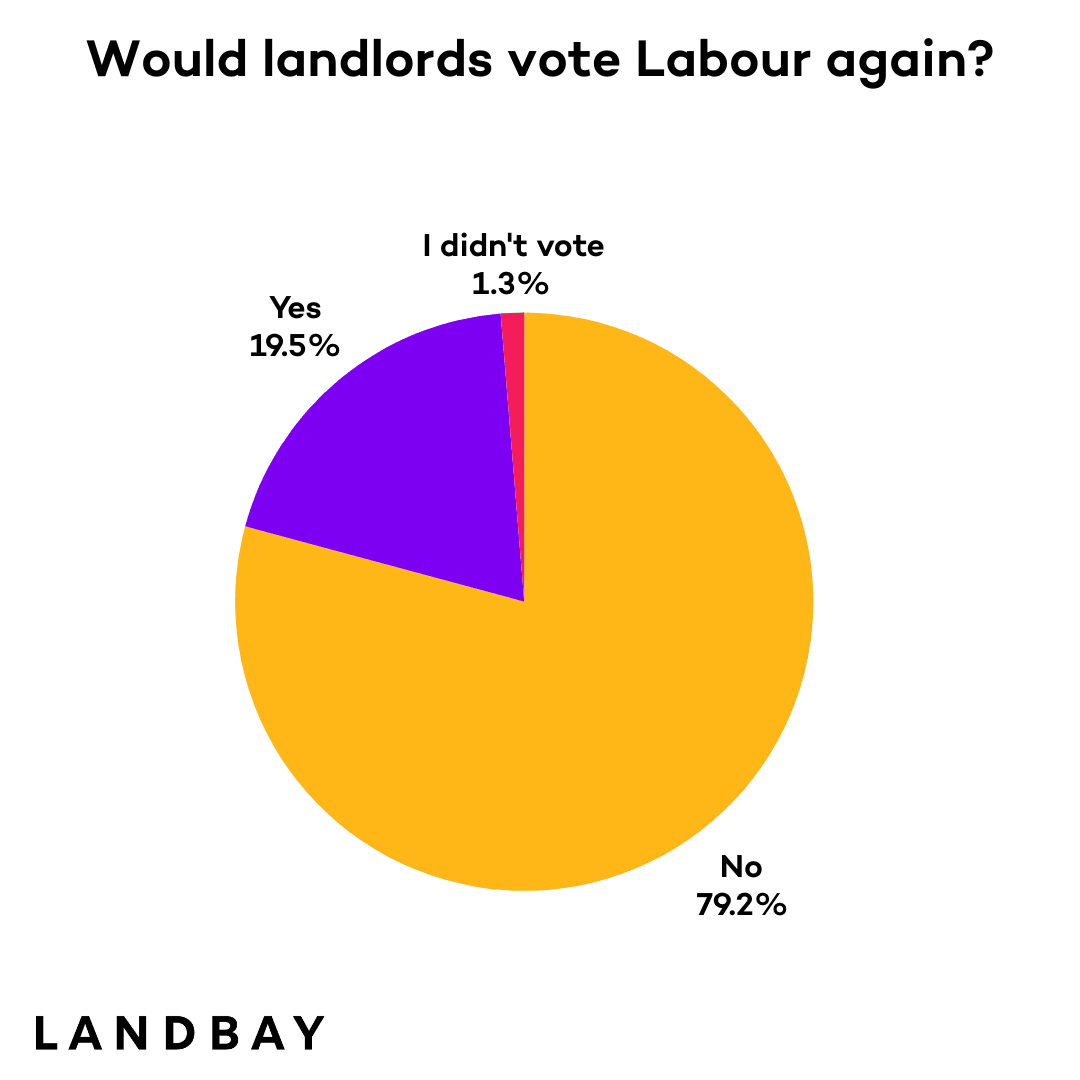

Nearly 80% of landlords who voted Labour in the last General Election say they would not have done so had they known about the Chancellor’s decision to increase Stamp Duty on second homes and investment properties.

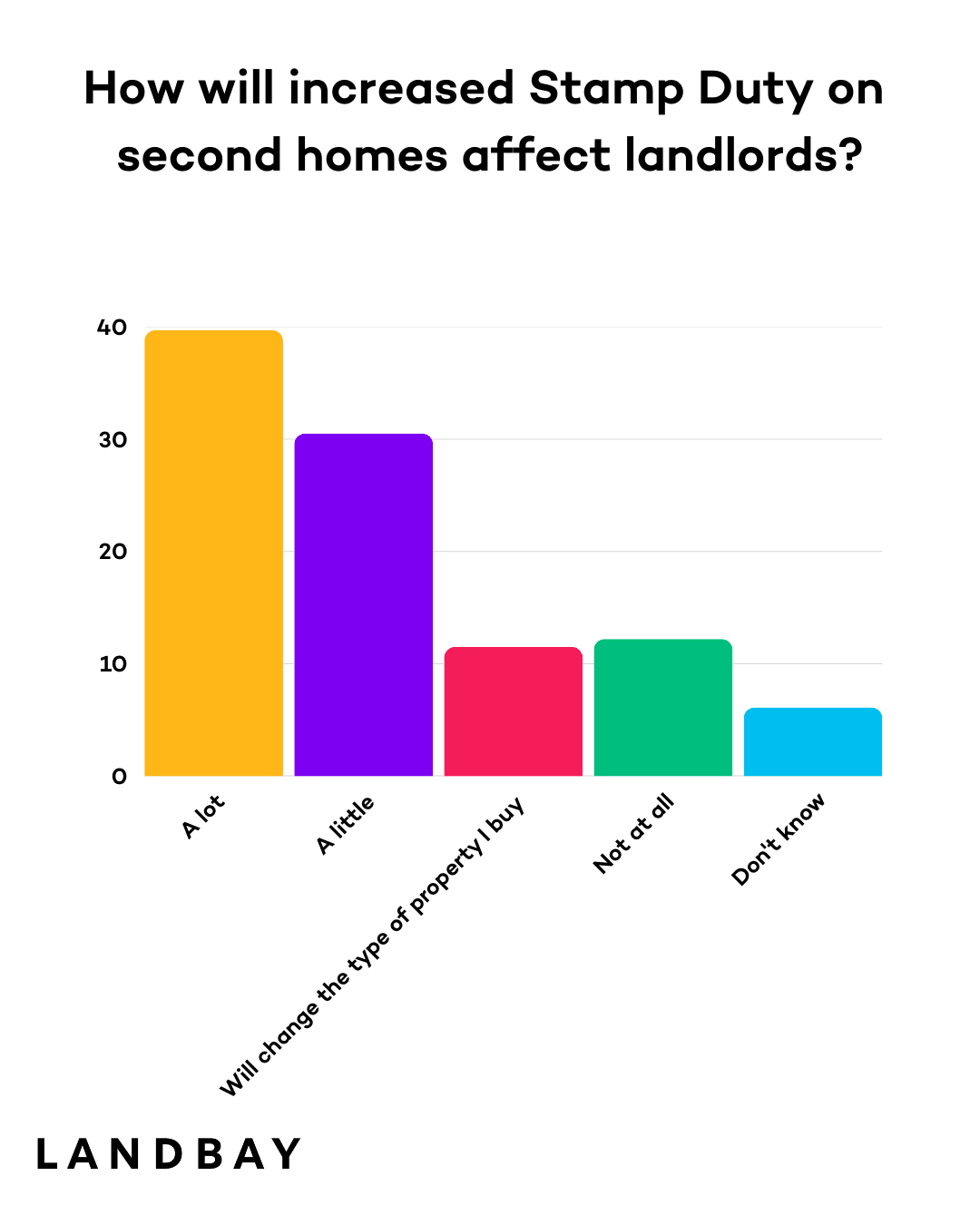

Confidence in the buy-to-let sector is important for maintaining a healthy rental market, yet 63% of landlords are unimpressed with the current housing policies. While 39% say the increase in Stamp Duty from 3% to 5% will significantly impact their investment decisions, 30% see it as a minor adjustment, and 12% say it will not affect them. As one landlord said, “2% isn’t a big deal if you take a long-term view.”

Beyond tax changes, landlords feel increasingly misrepresented in political and media narratives. Many believe a “landlord bashing” agenda exists, where responsible landlords are unfairly grouped with bad actors. One landlord noted: “It feels like the government wants to push out small landlords in favour of corporate investors, just like what’s happened in the student rental market.”

Despite these concerns, the rental market remains strong. Demand continues to outstrip supply, with many tenants actively seeking rental properties across the UK. With high house prices and affordability challenges for first-time buyers, the private rental sector is vital in providing much-needed housing. While some landlords pause investment, others actively explore opportunities in different regions.

As a buy-to-let lender, we support landlords and brokers as they navigate market changes. That’s why we’ve introduced our new product transfer range, designed to provide existing borrowers access to competitive rates when their fixed term ends, saving time and money. This offering enhances affordability by eliminating the need for a full remortgage, streamlining the process for landlords looking to retain their investments.

Our variable fee structures across all ranges allow for greater flexibility, enabling landlords to tailor their mortgage costs to suit their financial strategies. Combining competitive pricing with a simplified approach, we help you support your clients in managing their portfolios more effectively in an evolving market.

For more information about our products, contact your local BDM.